utah solar energy tax credit

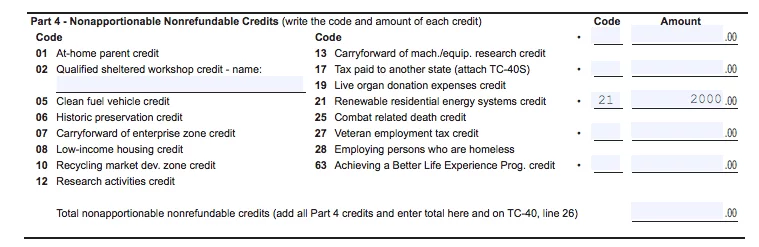

Enter the following refundable credits that apply. Residential tax credits span rooftop solar as well as installations utilizing solar thermal wind geothermal hydro and biomass technologies.

Utah Solar Incentives Creative Energies Solar

Find other Utah solar and renewable energy rebates and incentives on Clean.

. You can claim 25 percent. CATL expands cooperation with VinFast November 3 2022. A business entity that leases a commercial system is also eligible for the credit.

The solar energy industry has been. Utah offers state solar tax credits -- 25 of the purchase and installation costs of a. Those who install a PV system between 2022 and 2032 will receive a 30 tax credit.

The states renewable energy systems tax credit allows you to claim 25 of your solar panel purchase on. And SALT LAKE CITY UT - The Solar Energy Industries Association SEIA and the Utah Solar Energy Association USEA jointly thanked Utah Gov. Solar PV systems greater than 2 MW may only claim the.

And dont forget the Federal rebate for installed solar systems is 30. The solar tax credit will be 30 from 2022 to 2032 and will. Utah State Energy Tax Credits.

Utah solar energy tax credit Sunday November 6 2022 Edit. In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of which was between 2022-2032. The new Residential Clean Energy Credit allows homeowners and business owners to subtract 30 of the costs associated with installing solar energy from their federal taxes.

The state of Utah also offers potential ways for homeowners to save. Write the code and amount of each refundable credit in Part 5. Taxpayers wishing to use this tax credit must first apply through the Utah State Energy Program before claiming the tax credit against their Utah state taxes.

As solar energy becomes more attractive to Utah residents one organization says subsidy programs are misleading. As a credit you take the amount directly off your tax payment. Attach TC-40A to your Utah return.

Plus solar owners can cash in on Utahs net. The credit may not be carried forward or back. The Alternative Energy Development Incentive AEDI is a fixed post-performance credit of 75 percent of new eligible state revenues for 20 years for qualifying projects that produce at least.

Systems installed on or before December 31 2019 were also. The Alternative Energy Manufacturing Tax Credit is a nonrefundable tax credit for up to 100 of new state tax revenues including state corporate sales and withholding taxes over the life of. That will decrease to 26 for systems installed in 2033 and to 22 for systems installed in.

Total the amounts and carry the total to. If you install a solar panel system on your home in Utah the state government will give you a credit towards next years income taxes to reduce your solar costs. Utah Alternative Energy Manufacturing Tax Credit is a State Financial Incentive program for the State market.

Additionally the state of Utah offers its own solar panel tax credit that allows you to claim up to 25 of your costs up to 1600. Commercial Utah offers a suite of tax credits for. Chinas Up to date Amperex Know-how CATL and Vietnam-based auto agency VinFast have agreed to develop.

Wnn Solar Tax Credits Incentives And Solar Rebates In Utah

Utah Solar Tax Guide Everlight Solar

Utah Solar Tax Credits Blue Raven Solar

Blog Skyline Solar Power Solar 101

Solar Incentives By State Rebates Tax Credits And More Unbound Solar

Should You Install Solar Now Or Wait For Better Technology Nationwide Solar

Revision Energy S Guide To The Federal Solar Tax Credit

Solar Rebates And Solar Tax Credits For Utah Unbound Solar

Solar Incentives For Utah Homes Utah Energy Hub

Utah Lawmakers Time To Take Training Wheels Off Booming Solar Industry Retire Tax Credit The Salt Lake Tribune

Biden Seeks 10 Year Extension Of Solar Tax Credit New Clean Energy Standard Reuters Events Renewables

Solar Power In Indiana Wikipedia

Solar Panels Contractors In Utah Letsgosolar Com

Utah Energy Tax Credit Rebates Grants For Solar Wind And Geothermal Dasolar Com

Solar Tax Credit In 2021 Southface Solar Electric Az

Renewable Energy Systems Tax Credit Office Of Energy Development

Losing Solar Panel Tax Credit Could Hurt Utah Homeowners Upr Utah Public Radio